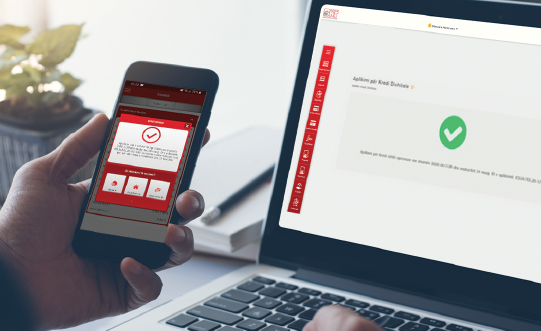

For the first time in the market BKT has launched the product “Digital Loan” through BKT Mobile and e-banking channels.

The Digital Loan Platform offers a service based on the most advanced technology, offering you the opportunity to apply online for a loan and receive decision on your application automatically without the need to visit BKT branches.

To apply for a digital loan, you need to be a user of Digital Banking channels (e-banking or BKT Mobile application). If you have not been registered yet, you may register by clicking on the e-banking / individual field or by downloading the BKT Mobile application on your phone.

Loan terms:

- The minimum loan amount is EUR 500, while the maximum loan amount is EUR 10,000

- The maximum repayment term is up to 84 months

- No guarantor

Qualification conditions:

- Kosovo citizen

- Individuals, 21 to 60 years old

- BKT salary receivers

- Clients who have active loan or credit card in BKT in the last 6 months and are willing to transfer salary to BKT

Necessary documentation

- For BKT salary receivers, no additional documents is required

- For clients that do not receive salary in BKT, must bring:

- Valid employment contract;

- Account statement (minimum for the last 6 months);

- Lien on salary.

Advantages of the Digital Loan:

Apply for a digital loan, fast and easy in 4 steps:

- Step 1

Check if you are eligible to apply - Step 2

Login / Register in e-banking or BKT Mobile - Step 3

Complete the Application and you will immediately receive the decision on your application - Step 4

Visit the branch to sign the loan agreement and while you are still in the branch, you will receive the money in your account